Gold surges past $3,000 amid global uncertainty

Robert Besser

17 Mar 2025, 23:09 GMT+10

- Gold prices have shattered the US$3,000 per ounce barrier for the first time, driven by escalating geopolitical tensions and economic uncertainty

- The precious metal’s record-breaking rally has been fueled by strong demand from central banks and investors looking for a safe-haven asset in volatile times

- Spot gold soared to an all-time high of $3,004.86 per ounce this week, marking its thirteenth record in 2025

WASHINGTON, D.C.: Gold prices have shattered the US$3,000 per ounce barrier for the first time, driven by escalating geopolitical tensions and economic uncertainty.

The precious metal's record-breaking rally has been fueled by strong demand from central banks and investors looking for a safe-haven asset in volatile times.

Spot gold soared to an all-time high of $3,004.86 per ounce this week, marking its thirteenth record in 2025. Prices have already surged 14 percent this year after gaining 27 percent in 2024.

"With continued central bank buying, there are multiple factors driving demand. In a backdrop of geopolitical uncertainty and ongoing tariff changes, appetite for gold remains strong," said Standard Chartered analyst Suki Cooper.

Market turbulence has intensified under U.S. President Donald Trump's administration, with his aggressive tariff policies triggering retaliatory measures from China and Canada. As inflation fears mount and trade tensions escalate, investors are increasingly turning to gold as a hedge against uncertainty.

"With equity markets selling off and unpredictable political risks, we are starting to see a return of Western investors to gold, which could propel it to much higher levels," said John Ciampaglia, CEO of Sprott Asset Management.

Gold stocks in COMEX-approved warehouses have climbed to a record 40.56 million ounces, but inflows have slowed in recent weeks as traders reassess market conditions.

Expectations of interest rate cuts by the U.S. Federal Reserve are also supporting gold's rally. Traders now anticipate three quarter-point reductions this year, up from two just days ago. The Fed has already slashed rates by 100 basis points since September but paused in January. Markets now expect easing to resume in June.

"The inflation data is helping to give the market confidence that the easing cycle will continue, given concerns around inflation and growth," said Cooper.

Investor appetite for gold-backed exchange-traded funds (ETFs) is surging. The SPDR Gold Trust (GLD), the world's largest gold-backed ETF, saw its holdings rise to 907.82 metric tons on February 25, the highest level since August 2023.

"There will likely be increased flows into safe-haven assets like gold, especially as investors move away from equity growth stocks amid rising uncertainties and future concerns," said Dina Ting, Head of Global Index Portfolio Management at Franklin Templeton.

Strong central bank demand has added momentum to gold's rise. China's central bank resumed purchases in November 2024 after a six-month pause, marking four consecutive months of buying. Analysts believe ongoing stockpiling could push prices even higher.

"Central banks may ramp up gold purchases amid market uncertainties, not just to hedge against the U.S. dollar but to anchor their currencies to gold as well," said Ting.

With continued concerns over the U.S. budget deficit and global instability, some analysts predict gold could reach $3,500. Macquarie issued a note suggesting that gold may challenge new highs, while Goldman Sachs raised its year-end 2025 forecast to $3,100.

Central banks purchased over 1,000 tons of gold for the third consecutive year in 2024, with buying surging 54 percent in the final quarter of the year, according to the World Gold Council.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Business Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Business Sun.

More InformationFinancial Markets

SectionPepsiCo nears $1.5 billion deal to acquire Poppi

HARRISON, New York: PepsiCo is on the verge of expanding its portfolio with a major acquisition. The beverage giant is reportedly in...

Gold surges past $3,000 amid global uncertainty

WASHINGTON, D.C.: Gold prices have shattered the US$3,000 per ounce barrier for the first time, driven by escalating geopolitical tensions...

Dollar General warns of slowing sales amid economic strain

GOODLETTSVILLE, Tennessee: Dollar General is bracing for a challenging year ahead, forecasting weaker-than-expected sales and profits...

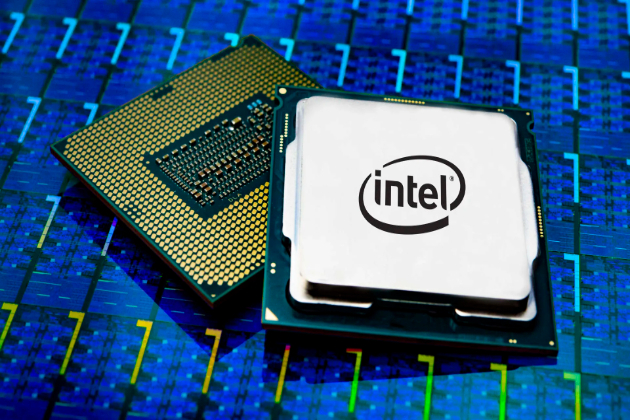

Intel stock jumps 15% as Lip-Bu Tan named CEO

SANTA CLARA, California: Intel's stock soared nearly 15 percent this week following the announcement that former board member Lip-Bu...

Jaguar Land Rover opts out of EV production at Tata’s India plant

NEW DELHI, India: Jaguar Land Rover (JLR) has decided against manufacturing electric vehicles at Tata Motors' upcoming $1 billion factory...

U.S. stocks rally hard despite drop in consumer sentiment

NEW YORK, New York - U.S. stocks rallied hard on Friday, boosted by strong rises around the world. Investors shrugged off a decline...

Technology

SectionSpotify paid a record $10 billion in music royalties in 2024

STOCKHOLM, Sweden: Spotify set a new milestone in 2024, paying out US$10 billion in royalties—the highest annual payout to the music...

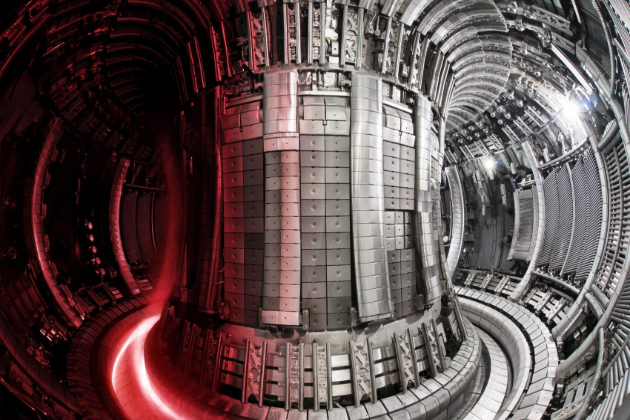

Virginia governor warns US must fast-track fusion or fall behind China

NEW YORK CITY, New York: The U.S. must accelerate its efforts to develop fusion energy or risk losing its edge to China, Virginia Governor...

UAE Cybersecurity Council detects 1,200 cases of internet begging in 2024

ABU DHABI, 17th March, 2025 (WAM) -- The UAE Cybersecurity Council has identified more than 1,200 cases of internet begging in 2024,...

NASA announces Sunita Williams and Butch Wilmore's return date to Earth

Washington, DC [US], March 17 (ANI): NASA astronauts Sunita Williams and Butch Wilmore, stranded at the International Space Station...

Stranded astronauts thank Musk, Trump for facilitating return; Sunita Williams says, "will be back before long"

Washington, DC [US], March 17 (ANI): NASA Asronauts Sunita Williams and Butch Willmore, who are to return to earth after being stranded...

Delhi Police to conduct exam for SHO appointments for first time in history

New Delhi [India], March 17 (ANI): In a ground-breaking move, Delhi Police is introducing a merit-based examination for the appointment...