Global institutions upbeat about China's sci-tech capital market

Xinhua

13 Mar 2025, 10:16 GMT+10

BEIJING, March 13 (Xinhua) -- China's rapid advancements in the artificial intelligence (AI) sector, exemplified by DeepSeek, a cost-competitive newcomer among global AI models, have captured global attention and driven capital inflows into the country's sci-tech capital market.

Since February, following Deutsche Bank's high-profile report declaring that "2025 is the year the investing world realizes China is outcompeting the rest of the world," several international investment banks have upgraded their ratings or raised target prices for the Chinese capital market.

Citi recently upgraded its rating for Chinese stocks to overweight. Chinese shares look attractive even after their recent rally, Citi strategists wrote, citing DeepSeek's AI technology breakthrough, the government's support for the tech sector and "still-cheap valuations."

Goldman Sachs anticipates that the widespread adoption of AI over the next decade could boost the overall earnings of Chinese stocks by 2.5 percent annually. It has also raised its targets for the MSCI China Index and the CSI 300 Index to 85 and 4,700, respectively, signaling potential double-digit growth for both indices over the next year.

Liu Jinjin, chief China equity strategist at Goldman Sachs, noted in a recent report that "investors' optimism about the growth and benefits of the AI economy has driven significant gains in the Hang Seng Tech Index and the MSCI China Index, which surged by 27 percent and 19 percent, respectively, from late January to late February."

The momentum in China's sci-tech sector, fueled by AI technology and its applications, has attracted international capital. Leading Chinese tech companies, including Alibaba, SMIC, Xiaomi and BYD, have seen notable stock price increases, reflecting growing investor confidence in China's innovation-driven growth.

Investors from the Republic of Korea (ROK), in particular, have shown heightened interest in Chinese stocks. According to the latest data released by Korea Securities Depository, ROK investors' monthly trading volume in Chinese mainland and Hong Kong stocks reached 782 million U.S. dollars in February, nearly tripling from a month earlier and hitting the highest level since August 2022.

Experts attribute this surge to China's rapid development in high-tech fields, which has significantly boosted investor confidence, with expectations that this enthusiasm will continue.

CITIC Securities described the current moment as a "pivotal historic opportunity" for global capital to invest in the Chinese stock market. The widespread application of AI across industries has significantly improved the efficiency and profitability of China's real economy.

During China's "two sessions" this year, the rise of DeepSeek and its global impact became a focal point. Wu Qing, head of China's top securities regulator, emphasized that DeepSeek's success has not only impressed the global AI industry but also redefined the world's perception of China's capabilities in technological innovation.

This achievement has driven a revaluation of Chinese assets, he noted. China will support the development of sci-tech innovation enterprises -- both listed and those in the pipeline -- to further enhance the appeal and investment value of the Chinese stock market, according to the China Securities Regulatory Commission.

To facilitate the listing of high-quality tech companies, the commission will adopt more inclusive issuance and listing systems, leveraging mechanisms such as the "green channel" and supporting the listing of pre-profit enterprises.

A mix of policies will be implemented to bolster sci-tech innovation, including refining the issuance and registration process for sci-tech innovation bonds and advancing the securitization of intellectual property assets, according to the commission.

"We are optimistic about the medium-term prospects for Chinese equities," stated Morningstar Investment Management and research teams in their 2025 Outlook.

They expect stimulus measures initiated in 2024 to continue evolving, cite a more benign regulatory backdrop, anticipate moderate earnings growth from Chinese companies, and maintain a positive outlook on several of the major technology firms as consumers regain their footing.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Business Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Business Sun.

More InformationFinancial Markets

SectionU.S. stocks stabilize after relentless losses

NEW YORK, New York - A slightly lower-than-expected CPI reading for February helped U.S. stocks to stabilize after some relentless...

New York office market rebounds as big investors hunt for deals

NEW YORK CITY, New York: New York's office market is showing signs of a comeback as major investors, including Blackstone, scout for...

DoorDash, Williams-Sonoma, and others soar on S&P 500 inclusion

SAN FRANCISCO, California: Shares of DoorDash, Williams-Sonoma, Expand Energy, and TKO Group surged in extended trading on March 7...

Another volatile day for Wall Street as Trump doubles-down on tariffs

NEW YORK, New York - The freefall fn U.S. stocks continued Tuesday with all the major indices taking a hit durin g the bulk of the...

Walmart faces pushback as it asks Chinese suppliers to cut prices

BENTONVILLE, Arkansas: Walmart is pressuring some Chinese suppliers to cut prices in response to President Donald Trump's imposed U.S....

US urges India to cut tariffs, boost defense buys for more trade

NEW DELHI, India: The United States is pressing India to lower tariffs and increase defense purchases to secure a stronger bilateral...

Technology

SectionGlobal institutions upbeat about China's sci-tech capital market

Humanoid robots are trained to swing their arms at the Zhejiang humanoid robot innovation center in Ningbo, east China's Zhejiang Province,...

NASA, SpaceX delay mission meant to bring back astronauts stranded on ISS

Florida [US], March 13 (ANI): NASA and SpaceX on Wednesday scrubbed the launch attempt of the agency's Crew-10 mission to the International...

SpaceX scrubs flight to rescue stranded astronauts

The mission was canceled less than an hour before launch due to a reported hydraulics issue with the launchpad SpaceX has aborted...

5G services now available in 773 out of 776 districts across India, 4.69 lakhs 5G BTS installed by Feb: Centre

New Delhi [India], March 12 (ANI): Fifth Generation or 5G services have been rolled out in all States/ UTs across the country and are...

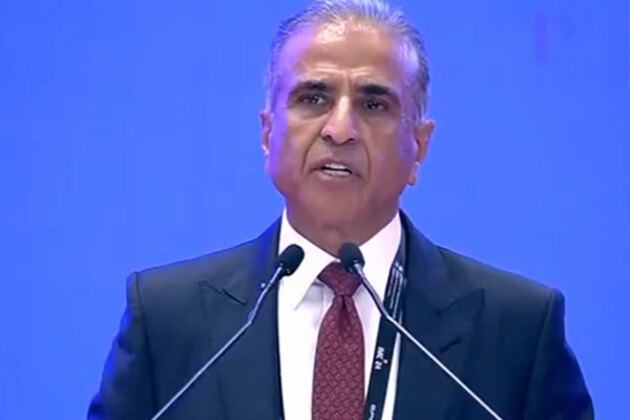

Airtel's Sunil Mittal welcomes collaboration of telecom and satellite players to connect the unconnected

New Delhi [India], March 12 (ANI): Bharti Enterprises Chairman Sunil Bharti Mittal has welcomed the collaboration between telecom and...

India, Sierra Leone hold 2nd Foreign Office Consultations, discuss bilateral ties

New Delhi [India], March 12 (ANI): The Second round of Foreign Office Consultations (FOC), co-chaired by Sevala Naik Mude, Additional...