US pending home sales in January hit record low amid high rates

Robert Besser

04 Mar 2025, 20:37 GMT+10

- Contracts to buy previously owned homes in the U.S. fell to a record low in January due to high mortgage rates and rising home prices, making it harder for buyers to afford homes

- The National Association of Realtors (NAR) reported that its Pending Home Sales Index, which tracks signed contracts, dropped 4.6 percent in January to 70.6, the lowest level ever recorded

- Economists had expected a smaller decline of 1.3 percent. Compared to last year, pending home sales were down 5.2 percent

WASHINGTON, D.C.: Contracts to buy previously owned homes in the U.S. fell to a record low in January due to high mortgage rates and rising home prices, making it harder for buyers to afford homes.

The National Association of Realtors (NAR) reported that its Pending Home Sales Index, which tracks signed contracts, dropped 4.6 percent in January to 70.6, the lowest level ever recorded. Economists had expected a smaller decline of 1.3 percent. Compared to last year, pending home sales were down 5.2 percent.

Lawrence Yun, NAR's chief economist, noted that severe winter weather might have contributed to the drop, but the main issue was high home prices and mortgage rates, which reduced affordability. Contracts fell in the Midwest, South, and West but rose slightly in the Northeast.

According to the Federal Housing Finance Agency, home prices increased by 4.7 percent over the past year. Mortgage rates, which averaged around seven percent in January, have now dropped slightly to 6.85 percent, based on data from Freddie Mac.

Despite the Federal Reserve cutting interest rates by 100 basis points since September, mortgage rates have remained high. The Fed paused further cuts in January to evaluate the impact of the Trump administration's economic policies, including tariffs, tax cuts, and mass deportations, which some economists fear could drive inflation.

Mortgage rates typically follow the 10-year Treasury yield, which has declined slightly due to weaker economic data. However, concerns over inflation, mainly due to tariffs potentially increasing prices, may limit further declines.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Business Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Business Sun.

More InformationFinancial Markets

SectionUS pending home sales in January hit record low amid high rates

WASHINGTON, D.C.: Contracts to buy previously owned homes in the U.S. fell to a record low in January due to high mortgage rates and...

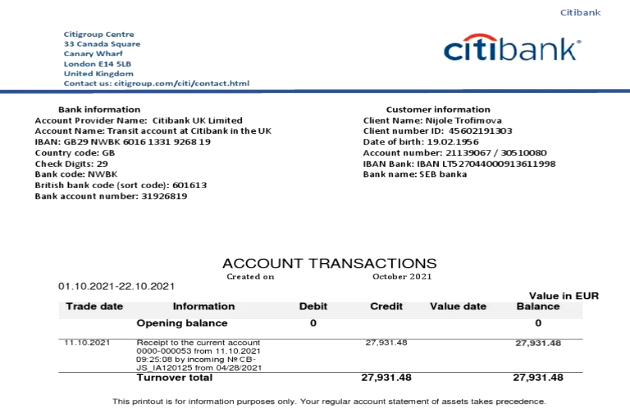

Citigroup mistakenly credits $81 trillion to customer instead of $280

NEW YORK CITY, New York: A routine banking transaction at Citigroup last April turned into a major blunder when the bank mistakenly...

Looming tariffs on trade torpedo U.S. stock markets

NEW YORK, New York - U.S. and Canadian stocks sank Monday, weighed down by President Donald Trump's looming trade tariffs. The introduction...

Nasdaq Composite sinks 497 points as trade tariffs loom

NEW YORK, New York - U.S. and Canadian stocks tumbled on Monday, the first trading day of March, with investors spooked by looming...

North Korean-backed hackers steal $1.5 billion from Dubai crypto firm

ROME, Italy: U.S. authorities have accused North Korean-backed hackers of stealing US$1.5 billion in cryptocurrency from Dubai-based...

Alibaba releases AI model Wan 2.1 to the public

BEIJING, China: Alibaba has made its video- and image-generating AI model, Wan 2.1, publicly available, marking a significant step...

Technology

SectionAlibaba releases AI model Wan 2.1 to the public

BEIJING, China: Alibaba has made its video- and image-generating AI model, Wan 2.1, publicly available, marking a significant step...

AI and Cybersecurity top the list of emerging governance risks in India: Report

Mumbai (Maharashtra) [India], March 4 (ANI): As Indian enterprises are confronted by an increasingly complex risk management landscape,...

Update: DeepSeek's progress demonstrates inclusiveness of Chinese technology: spokesperson

BEIJING, March 4 (Xinhua) -- The rise of Chinese tech companies like DeepSeek has shed light on the innovative and inclusive approach...

China uses DeepSeek AI for surveillance and information attacks on US

The United States may become the second country after Australia to ban China’s DeepSeek artificial intelligence on government devices....

SpaceX postpones eighth test of Starship rocket after booster issue

Washington, DC [US], March 4 (ANI): SpaceX postponed its eighth test of the Starship rocket just before its scheduled launch on Monday....

Musk slams Zelensky for rejecting ceasefire

The US-based billionaire has accused the Ukrainian leader of letting men die in trenches instead of seeking a peace deal ...