How much does it cost to get your car loan refinanced-

iCrowd Newswire

31 May 2023, 02:32 GMT+10

If you want to lower your monthly car payment, you may want to consider refinancing your car loan. Refinancing allows you to take out a new loan with a lower interest rate to pay off your existing loan. While this can be a great way to save money, it's important to know there are costs associated with refinancing.

Though there are specific fees to refinance car loan agreements, there are also opportunity costs you won't see on the loan contract. As a result, it's important to do your research and ensure that refinancing is the right choice for you before moving forward. Read on to learn more.

Costs Associated with Auto Refinancing

Auto refinancing can be a good way to save money if you qualify for a lower interest rate than you are currently paying. However, there are also some costs associated with refinancing, including the following:

Application Fee: There is typically no cost to apply to refinance your vehicle loan, but some lenders may charge a fee to cover the cost of processing the loan.

Early Payoff Fee: If you still owe money on your current loan, you may be charged a fee for paying it off early. This fee is typically around 1% of the remaining balance.

Origination Fee: The new lender charges a fee for originating your loan. It is typically a percentage of the loan amount, ranging from 0.5% to 1%.

Title and Registration Fees: When you refinance a car loan, you need to pay new title and registration fees to transfer the vehicle to the new lienholder. These fees vary by state but typically range from $50 to $200.

You'll also need to factor in the costs of any additional products or services you choose to add when you refinance, like extended warranties or gap insurance. These products can add to the overall cost of refinancing, so be sure to consider them when deciding whether to refinance your auto loan.

The Opportunity Costs of Auto Refinancing

Uncertainty of the opportunity costs associated with refinancing can lead to "buyer's regret" months or years after signing a new loan contract. So, it's important to understand what those are before applying.

Credit Impact: Refinancing your car loan can negatively impact your credit score. When lenders make a hard inquiry on your credit report to view your creditworthiness, your score can drop by a few points. Your credit score can also drop when you take on any other type of new credit account.

Trade-in Value: There is a possibility that your vehicle will have a lower trade-in value if it has been refinanced. A lower trade-in value increases the need for more of a down payment, and you may have to finance more of the purchase price, making it harder to buy a new car in the future.

Future Loan Approval: Be mindful of making other large purchases around the time you plan to refinance, like buying a house or another car. Banks may be reluctant to approve two loan requests that are too close together. Remember, due to reporting lags, it takes some time for the paid-off car loan to drop off your credit history.

Is refinancing the right option for you?

Refinancing an auto loan is a great move if it's carefully thought out and the math reveals you'll get short-term and long-term savings from it. Understanding the potential impact on your credit score and any other financing plans you may consider is also important.

Consider all this carefully, then find a lender that can provide suitable terms and conditions for refinancing your auto loan.

SPONSORED CONTENT

See Campaign: https://www.iquanti.com

Contact Information:

Name: Keyonda GoosbyEmail: [email protected]Job Title: PR Specialist

Tags:Reportedtimes, Google News, Financial Content, ReleaseLive, IPS, PR-Wirein, CE, Go Media, Extended Distribution, iCN Internal Distribution, English Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Business Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Business Sun.

More InformationFinancial Markets

SectionEconomic data gives welcome relief to Wall Street

NEW YORK, New York - Strong economic data jump-started U.S. stocks and the dollar Tuesday, a welcome reprieve after weeks of pressure...

PepsiCo cleared in FTC case over Walmart discounts

NEW YORK CITY, New York: This week, the U.S. Federal Trade Commission (FTC) dropped its lawsuit against PepsiCo, which had accused...

Builder discounts drive sales spike, but housing outlook wary

WASHINGTON, D.C.: New single-family home sales in the U.S. rose sharply in April to their highest level in over three years as builders...

Allegations of secret nursing home deals shake UnitedHealth

MINNETONKA, Minnesota: UnitedHealth shares took a sharp hit this week, after a report by the UK's Guardian alleged the healthcare giant...

Trump-backed $1.5 billion golf project breaks ground near Hanoi

HUNG YEN, Vietnam: A new US$1.5 billion luxury golf and residential project backed by the Trump Organization officially broke ground...

Aussie firms upbeat on China outlook despite trade tensions

SYDNEY, Australia: Australian businesses are feeling optimistic about their prospects in China despite escalating global trade tensions,...

Technology

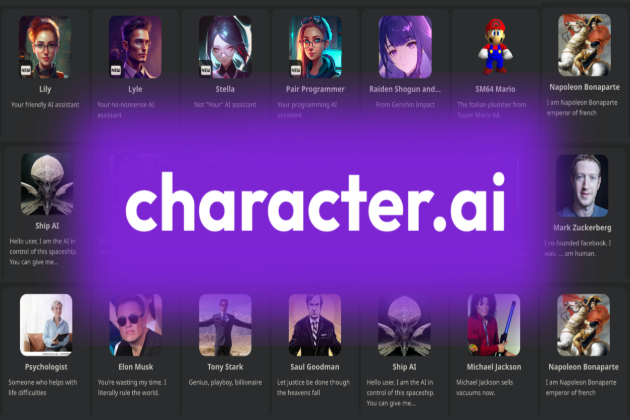

SectionMother sues Google, Character.AI after son’s death

WASHINGTON, D.C.: A Florida mother, Megan Garcia, is suing Google and AI startup Character.AI, claiming their chatbot played a role...

SpaceX Starship completes ascent burn, coasts through space; Musk signals faster launches ahead

Washington D.C.[US], May 28 (ANI): SpaceX's Starship successfully completed its ascent burn and is now coasting through space, according...

India's first AI SEZ in Chhattisgarh RackBank to invest Rs 1000 crores

Raipur (Chhattisgarh) [India], May 27 (ANI): India's first AI-centric Special Economic Zone (SEZ) is being established in Nava Raipur,...

Network-Attached Storage (NAS): Common Data Loss Scenarios and Recovery Options

HT Syndication New Delhi [India], May 27: Data loss can be a nightmare for both individuals and businesses--even more so when the...

Bajaj Markets Makes Choosing the Right Credit Card Easy!

HT Syndication Pune (Maharashtra) [India], May 26: Finding the ideal credit card is simpler than ever with Bajaj Markets, a financial...

International cyberbattle champions crowned at hack fest in Moscow

More than 40 teams from 18 countries took part in the competition during the Positive Hack Days (PHDays Fest) event ...