Why People With Good Credit Scores Are About To Get Penalized By Administration

iCrowd Newswire

25 May 2023, 23:32 GMT+10

Starting this May, homeowners with high credit scores may see an increase in their mortgage rates. But why is this happening, and is it really as bad as everyone's making it seem?

Why are mortgage fees changing?

Effective May 1, 2023, the Federal Housing Finance Agency (FHFA) has updated its fee structure for loan-level price adjustments (LLPAs). The goal of this update is to make it easier for those with lower credit scores to become homeowners and to make homeownership more equitable in an increasingly-harsh economic climate.

But it's not as bad as you think.

Many articles have focused heavily on the notion that those with higher credit scores will pay more in fees when this is only partially true. On the surface, those with scores of 659 ("fair") or below would pay an LLPA lower than a mortgage applicant with a score of 740+ ("excellent"), which would make it seem like those with higher scores are being penalized by the administration.

However, LLPAs are not the only fees associated with mortgages and are only part of FHA-based loans. Other mortgage-related fees will still be lower for those with high credit scores, as the loans you can get with good credit often have competitive rates that more than make up for a slight uptick in LLPAs.

Further, a statement from the FHFA.gov website explicitly states that "?higher-credit-score borrowers are not being charged more so that lower-credit-score borrowers can pay less. The updated fees, as was true of the prior fees, generally increase as credit scores decrease for any given level of down payment… Many borrowers with high credit scores or large down payments will see their fees decrease or remain flat."

Should I lower my credit score to get a better rate?

Definitely not! In fact, you should do the opposite and focus your effort on getting your score as high as possible before applying for a mortgage.

Your credit score affects more than your LLPA rate and can have a drastic effect on the amount of money you have over the course of your lifetime. Those with higher credit scores will have more opportunities for lower interest rates, more favorable repayment terms, and lower fees than someone with a "bad" or "fair" score.

Low credit scores can also have an effect on your job opportunities, as employers in the financial industry or those who work directly with government agencies will look at credit scores as part of their background checks.

And while it's possible to get a personal loan for fair credit scores, the amount of interest and closing fees you'll have to pay make the idea of intentionally lowering your score an expensive mistake to learn.

The bottom line

Despite what many clickbait articles would have you believe, it's not likely that those with higher credit scores will have a drastic change to their mortgage rates. However, it's crucial that every homeowner, and potential homebuyer, stay on top of the latest changes to FHA and non-FHA-backed loans to ensure you're well-informed on your options and can get the best mortgage rate possible.

See Campaign: https://www.credello.com

Contact Information:

Name: Keyonda GoosbyEmail: [email protected] Title: Consultant

Tags:Reportedtimes, IPS, Go Media, ReleaseLive, Google News, CE, Extended Distribution, iCN Internal Distribution, English Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Business Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Business Sun.

More InformationFinancial Markets

SectionMicrosoft trims jobs to manage soaring AI infrastructure costs

REDMOND, Washington: Microsoft is the latest tech giant to announce significant job cuts, as the financial strain of building next-generation...

Stocks worldwide struggle to make ground Friday with Wall Street closed

LONDON UK - U.S. stock markets were closed on Friday for Independence Day. Global Forex Markets Wrap Up Friday with Greeback Comeback...

Nvidia briefly tops Apple’s record in AI-fueled stock rally

SANTA CLARA, California: Nvidia came within a whisker of making financial history on July 3, briefly surpassing Apple's all-time market...

ICE raids leave crops rotting in California, farmers fear collapse

SACRAMENTO, California: California's multibillion-dollar farms are facing a growing crisis—not from drought or pests, but from a sudden...

Trump signals progress on India Trade, criticizes Japan stance

WASHINGTON, D.C.: President Donald Trump says the United States could soon reach a trade deal with India. He believes this deal would...

Grammarly acquires Superhuman to boost AI workplace tools

SAN FRANCISCO, California: Grammarly is doubling down on AI-powered productivity tools with the acquisition of Superhuman, a sleek...

Technology

SectionMicrosoft trims jobs to manage soaring AI infrastructure costs

REDMOND, Washington: Microsoft is the latest tech giant to announce significant job cuts, as the financial strain of building next-generation...

Nvidia briefly tops Apple’s record in AI-fueled stock rally

SANTA CLARA, California: Nvidia came within a whisker of making financial history on July 3, briefly surpassing Apple's all-time market...

Grammarly acquires Superhuman to boost AI workplace tools

SAN FRANCISCO, California: Grammarly is doubling down on AI-powered productivity tools with the acquisition of Superhuman, a sleek...

Nvidia execs sell $1 billion in stock as AI boom drives record prices

SANTA CLARA, California: Executives at Nvidia have quietly been cashing in on the AI frenzy. According to a report by the Financial...

Beijing crowds cheer AI-powered robots over real soccer players

BEIJING, China: China's national soccer team may struggle to stir excitement, but its humanoid robots are drawing cheers — and not...

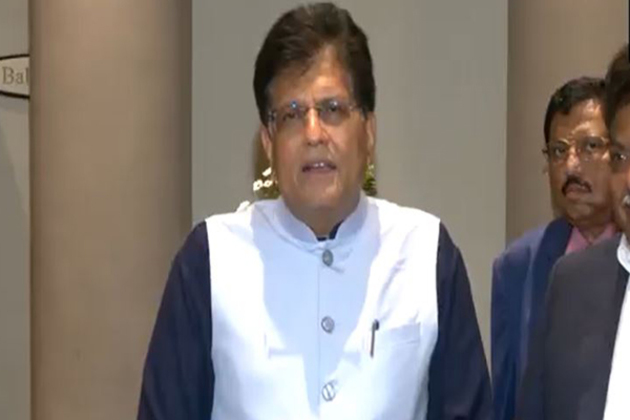

Piyush Goyal highlights Rs 3 lakh crore schemes for research, employment, and startups

Bengaluru (Karnataka) [India], July 5 (ANI): Union Minister of Commerce and Industry Piyush Goyal, during an interactive session with...