Prepaid Card vs. Regular Credit Card: Which is Right for Me-

iCrowd Newswire

22 Mar 2023, 05:32 GMT+10

These days, there are plenty of ways to spend money without carrying cash. Two popular options are prepaid cards and credit cards. Prepaid cards let you load money onto a card, whereas credit cards let you borrow money up to a particular credit limit. This article will explore the differences between prepaid and regular cards to help you choose the right card type for your situation.

How do prepaid cards work?

Prepaid cards let you load a card ahead of time with funds by paying for it. For example, you can spend $300 to load a prepaid card with $300. Then, you can make purchases with that card until the funds run out. This allows you to track your spending and avoid overspending easily. Plus, it's fairly safe - you can only lose as much as is on the card if lost or stolen.

How do regular credit cards work?

Regular credit cards let you borrow as much as you need up to a credit limit, then repay at your leisure as long as you meet the minimum payment. Interest accumulates on unpaid balances, then capitalizes onto that balance, meaning it is added to the balance. U.S. law limits your liability, and sometimes eliminates it entirely, if lost or stolen.

How to decide between a prepaid card and credit card

Here's how to choose between a prepaid and credit card:

1. Your credit score

Credit cards require a credit check in many cases, which dings your score temporarily. Additionally, your approval chances may be lower if you have less than perfect credit. But keep in mind that poor-credit cards may be available, and you can use the card to build credit.

Prepaid cards don't require a credit check. All you have to do is pay for them. So, if you have a lower score or don't want to do a credit check, this type of card might be the right option. Keep in mind that there are also loans available for borrowers with poor credit, like cash advances, if you want to consider alternative options.

2. Your spending habits

If you have good spending habits, consider a credit card. Credit cards offer limits in the thousands to tens of thousands, giving you a lot of spending power. You just have to be careful not to overspend.

If you're still working on your spending habits, a prepaid card could be the better choice. You can't spend more than you put on the card, preventing you from overspending.

3. How fast you need the card

The credit card approval process can take a bit longer because of the credit check and income and employment verification. Then, you must wait for the card to be sent to you. Prepaid cards don't ask for any of these things. All you do is pay for the card and receive it. This speeds the process along and eliminates the chance of time-wasting denials.

The bottom line

Both prepaid cards and credit cards have pros and cons, suiting them for different types of people. Prepaid cards require no bank account or credit score - just the money to pay for it. At the same time, you only get as much as you pay for. This can make them suitable for people with poor credit who need to build good spending habits.

Credit cards let you borrow money instead of using your own. They require a credit check and offer a much higher limit. Poor-credit options are available, but these cards are generally a better choice for those with credit histories and good spending habits. Overall, make sure to evaluate your financial habits, credit score, and how quickly you need the card to choose the right option for you.

See Campaign: https://www.iquanti.com

Contact Information:

Name: Keyonda GoosbyEmail: [email protected]Job Title: PR Specialist

Tags:IPS, Reportedtimes, Google News, ReleaseLive, PR-Wirein, CE, Go Media, Extended Distribution, iCN Internal Distribution, English Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Business Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Business Sun.

More InformationFinancial Markets

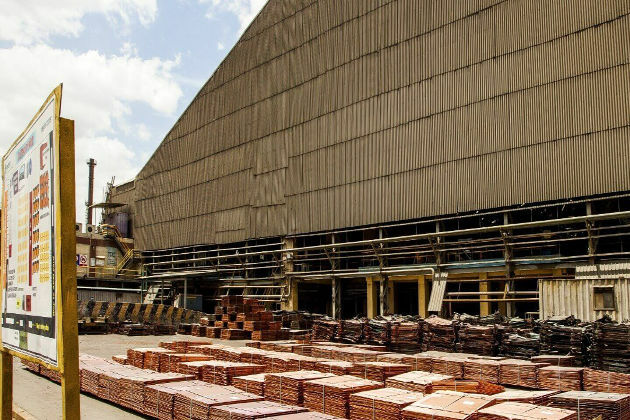

SectionIndia seeks WTO nod for retaliatory tariffs on US

NEW DELHI, India: India has submitted a revised proposal to the World Trade Organization (WTO) in Geneva to implement retaliatory tariffs...

AI boom propels Nvidia to historic market cap milestone

SAN FRANCISCO, California: Nvidia, the Silicon Valley chipmaker at the heart of the artificial intelligence boom, this week briefly...

AI saves $500 million for Microsoft as layoffs reshape strategy

REDMOND, Washington: Artificial intelligence is transforming Microsoft's bottom line. The company saved over US$500 million last year...

FTC’s rule to ease subscription cancellations struck down by court

WASHINGTON, D.C.: A federal rule designed to make it easier for Americans to cancel subscriptions has been blocked by a U.S. appeals...

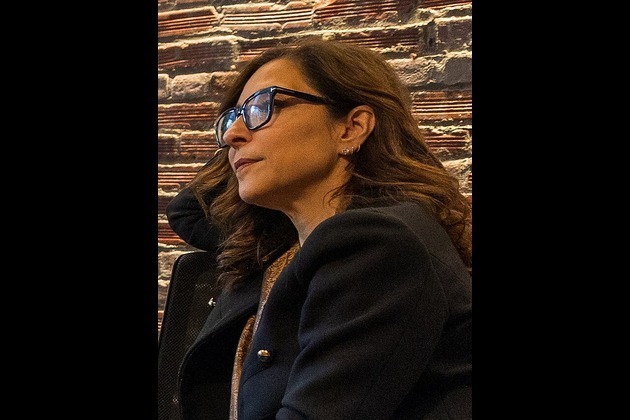

Musk’s X loses CEO Linda Yaccarino amid AI backlash, ad woes

BASTROP, Texas: In a surprising turn at Elon Musk's X platform, CEO Linda Yaccarino announced she is stepping down, just months after...

Ex-UK PM Sunak takes advisory role at Goldman Sachs

NEW YORK CITY, New York: Former British prime minister Rishi Sunak will return to Goldman Sachs in an advisory role, the Wall Street...

Technology

SectionAI boom propels Nvidia to historic market cap milestone

SAN FRANCISCO, California: Nvidia, the Silicon Valley chipmaker at the heart of the artificial intelligence boom, this week briefly...

AI saves $500 million for Microsoft as layoffs reshape strategy

REDMOND, Washington: Artificial intelligence is transforming Microsoft's bottom line. The company saved over US$500 million last year...

Musk’s X loses CEO Linda Yaccarino amid AI backlash, ad woes

BASTROP, Texas: In a surprising turn at Elon Musk's X platform, CEO Linda Yaccarino announced she is stepping down, just months after...

Rubio impersonator used AI to reach officials via Signal: cable

WASHINGTON, D.C.: An elaborate impersonation scheme involving artificial intelligence targeted senior U.S. and foreign officials in...

TikTok building U.S.-only app amid pressure to finalise sale

CULVER CITY, California: TikTok is preparing to roll out a separate version of its app for U.S. users, as efforts to secure a sale...

NASA to telecast Axiom Mission 4 departure on July 14; India's Shubhanshu Shukla set to return from ISS

Houston [US], July 12 (ANI): The National Aeronautics and Space Administration (NASA) has announced that it will provide live coverage...